Summary

- Successful investing is the key to financial stability and building wealth. Learn what you really need to know to invest safely and successfully.

- Debunk investing myths such as - investing is complicated, one must know advanced math, building wealth requires taking risks, stock markets are dangerous etc.

- Benjamin Graham was Warren Buffett's professor and mentor. Learn how Graham's methods can be applied - as faithfully as possible - to today's stock markets using modern technology.

Contents

Introduction

Warren Buffett is possibly the world's most successful investor, and is known for his proficiency with stocks. Benjamin Graham was Warren Buffett's professor and mentor at Columbia Business School. In this article, we'll also look at how Graham's teachings on stock selection can be applied - as faithfully as possible - to today's stock markets using modern technology, allowing us to invest safely and successfully.

What Are Stocks and How Do They Grow

Owning a stock is the legal equivalent of owning a share of a company. For ease of investing, stocks are traded on stock markets. The price quoted for a stock on the market changes every day, and there are often large differences between the underlying worth of a stock and the price quoted for it. Highly underpriced and overpriced stocks tend to correct themselves over time, as do highly underpriced and overpriced markets as a whole.

If a stock is chosen correctly, one's investment will grow as the stock price corrects itself, and also as the company grows. This is where Graham's teachings come into play - finding the right companies at the right price. Companies and their accountants are constantly trying to make their stock look more attractive to investors. The challenge for investors is to uncover the facts behind the financial statements and annual reports.

Stocks also have many advantages over other investments. They have more liquidity, they are naturally hedged (protected) against inflation, and most importantly, they have historically beaten all other forms of investment.

Quantitative Measures - EPS and BVPS

The first numbers to look at when evaluating a stock are its Earnings Per Share (EPS) and Book Value Per Share (BVPS). They tell us how much we're getting for our money.

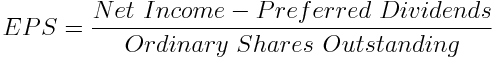

Earnings Per Share

EPS tells us how much profit the company makes per share.

EPS combined with price gives us a rough idea of the rate of return we can expect on our investment. EPS and Price are usually mentioned together as the P/E ratio, or Price-to-Earnings ratio.

Book Value Per Share

BVPS is the theoretical liquidation value of the stock. That is, if the company were to close tomorrow, BVPS tells us how much we would be paid per share after all the company's assets are sold at their depreciated prices, and all liabilities are paid.

However, most companies also include Goodwill and other Intangibles — which have no resale value — in their balance sheets. It's important to use only tangible assets when calculating liquidation values.

Qualitative Categories - Defensive, Enterprising and NCAV

When buying something, we also need to look at how good it is, and not just how much we're getting.

Graham recommended three different measurable categories of stocks, with different quantitative (EPS and BVPS) and qualitative (Growth and Stability) requirements for each category. Just as with buying anything else, higher quality stocks are costlier; i.e., we pay more for them per dollar of EPS and BVPS.

First Category - Defensive

The safest (but costliest) category of stocks recommended by Graham were for Defensive investors. The criteria that Graham specified for identifying them are as follows:

1. Not less than $100 million of annual sales.

[This works out to $500 million today based on the difference in CPI/Inflation from 1973]

2-A. Current assets should be at least twice current liabilities.

2-B. Long-term debt should not exceed the net current assets.

3. Some earnings for the common stock in each of the past 10 years.

4. Uninterrupted [dividend] payments for at least the past 20 years.

5. A minimum increase of at least one-third in per-share earnings in the past 10 years.

6. Current price should not be more than 15 times average earnings of the past three years.

7. Current price should not be more than 1½ times the book value.

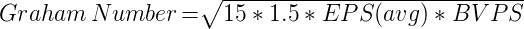

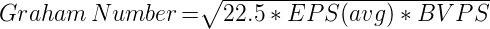

As a rule of thumb, we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5.

Graham's recommended price for Defensive grade stocks can be calculated from criteria #6 and #7. This price is popularly known as the Graham Number.

Note that the Graham Number is designed to quantitatively assess any stock that meets the Defensive qualitative requirements, regardless of sector or industry.

For example, a public utility company that is typically low on Earnings will need a higher than average asset figure to justify its price. Similarly, a Financial Services company that is typically low on assets will need a higher than average Earnings figure to be an acceptable investment.

Graham recommended a minimum portfolio size of 10 for Defensive grade stocks; or in other words, not more than 10% of one's portfolio per Defensive grade stock.

Assessment Results on GrahamValue

If the stock meets the qualitative criteria (#1 to #5) for Defensive investment above:

Graham Grade = Defensive

Intrinsic Value = Defensive Price (Graham №)

Second Category - Enterprising

For Enterprising investors who are looking for greater profits — and are willing to put in more effort into the maintenance of their portfolio — Graham then recommended the following criteria for identifying Enterprising grade stocks:

[For issues selling at P/E multipliers under 10]

1-A. Current assets at least 1½ times current liabilities.

1-B. Debt not more than 110% of net current assets.

2. Earnings stability: No deficit in the last five years covered in the Stock Guide.

3. Dividend record: Some current dividend.

4. Earnings growth: Last year's earnings more than those of 1966.

[Corresponds to the earnings of 5 years ago]

5. Price: Less than 120% net tangible assets.

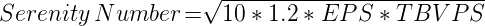

Thus, the price limit for a stock meeting Enterprising quality requirements is the lower of 120% net tangible assets, or 10 times Trailing EPS. We can combine the two — as Graham did for the Defensive Price — to yield a quantitative price calculation similar to the Graham Number. We'll call this the Serenity Number.

As with the Graham Number, the Serenity Number too applies to any stock — regardless of sector or industry — because it's a combination of both Assets and Earnings. A lower value in one will have to be compensated for by a higher value in the other.

GrahamValue's recommendation is for a minimum portfolio size of 20 for Enterprising grade stocks; or in other words, not more than 5% of one's portfolio per Enterprising grade stock.

Assessment Results on GrahamValue

If the stock meets the qualitative criteria (#1 to #4) for Enterprising investment above:

Graham Grade = Enterprising

Intrinsic Value = Enterprising Price (Serenity №)

Third Category - NCAV (Net Current Asset Value or Net-Net)

These stocks are also known as Net-Nets or cigar-butt stocks today. Graham did recommend these stocks for Enterprising investors, but with additional qualitative checks and diversification requirements.

Bargain Issues, or Net-Current-Asset Stocks

the results of buying 30 issues at a price less than their net-current-asset value

It always seemed, and still seems, ridiculously simple to say that if one can acquire a diversified group of common stocks at a price less than the applicable net current assets alone—after deducting all prior claims, and counting as zero the fixed and other assets— the results should be quite satisfactory.

If we eliminated those which had reported net losses in the last 12-month period we would be still left with enough issues to make up a diversified list.

These criteria give us stocks selling for less than their cash worth alone, and with positive earnings in the last year.

The positive EPS requirement is the qualitative check for NCAV stocks; and is very important. There's not much point buying a stock for its current assets (cash equivalents) alone, if the company's losing money.

Since NCAV stocks undergo the least qualitative tests of all of Graham's categories, they also require the most diversification. Graham recommended a portfolio size of 30 for NCAV stocks; or in other words, not more than 3.3% of one's portfolio per NCAV stock.

Assessment Results on GrahamValue

If the stock has a positive EPS and a positive Net Current Asset Value:

Graham Grade = NCAV (Net-Net)

Intrinsic Value = NCAV Price (Net Current Asset Value)

Finding Graham Stocks Today - Classic Graham Screening

Today's data mining software makes it relatively easy to find stocks that clear even such elaborate criteria.

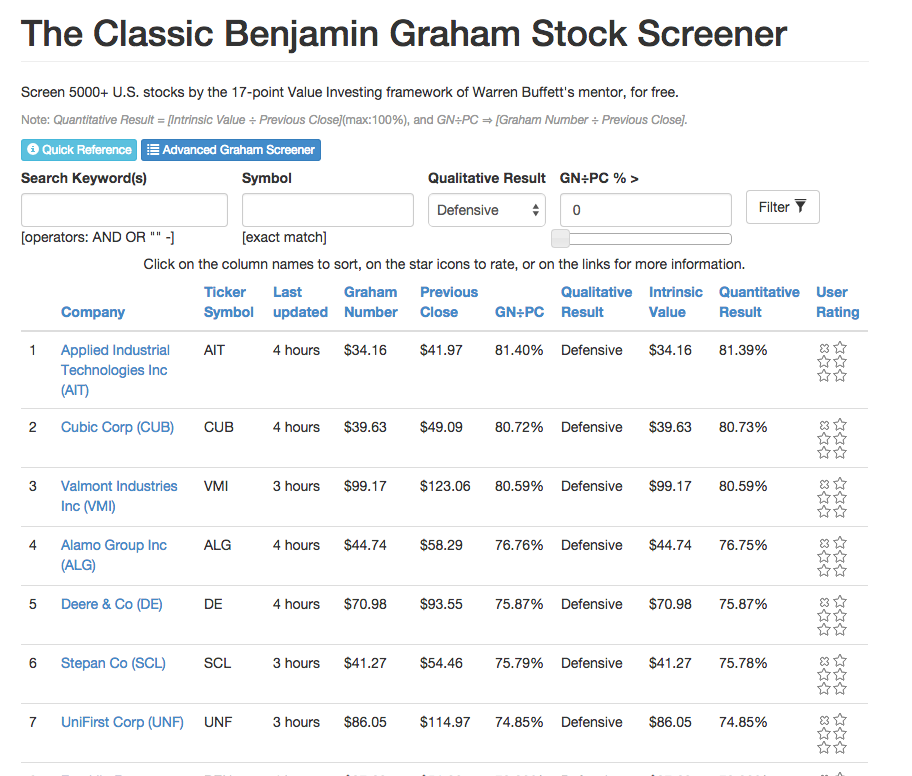

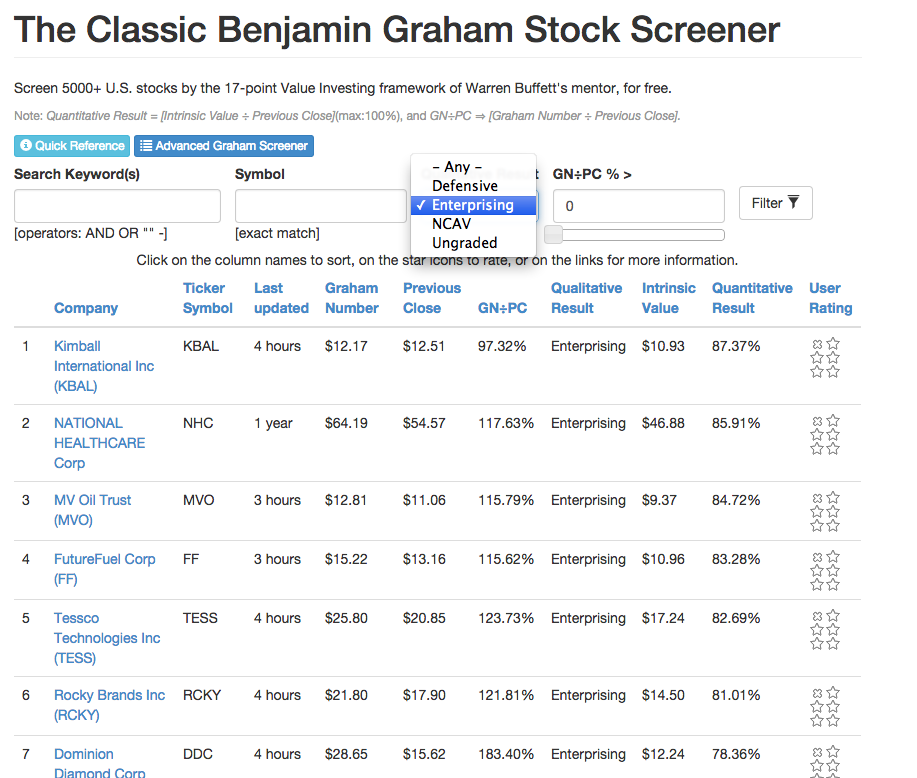

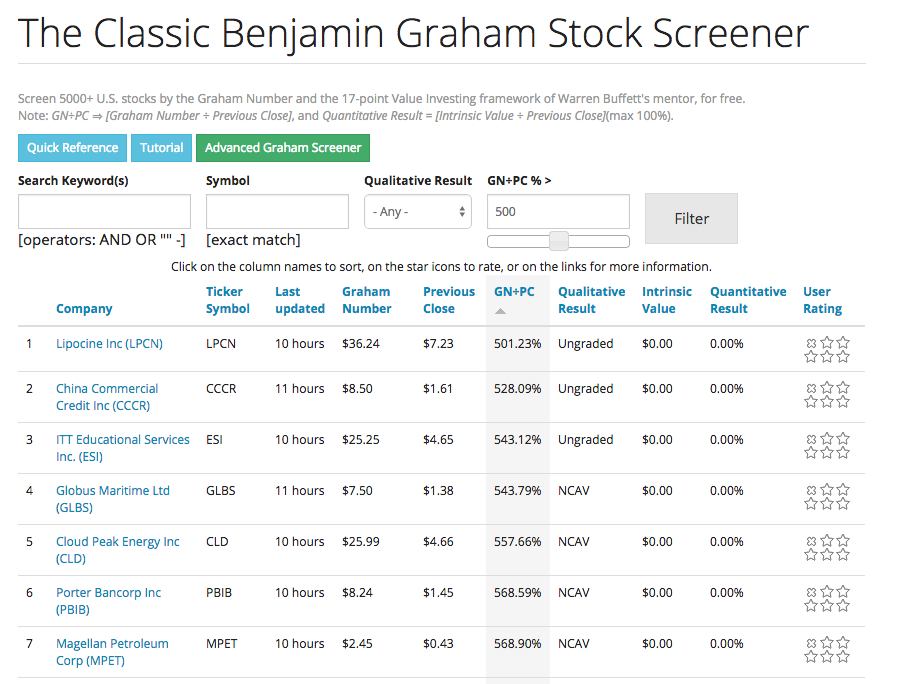

GrahamValue's algorithms apply the above 17-point framework to 5000+ U.S. stocks. The free Classic Graham Screener lists all stocks meeting up to 70% of Graham's quantitative criteria. Shown below is a list of such stocks that meet all of Graham's qualitative Defensive criteria.

Similar searches can also be done for Graham's Enterprising and NCAV (Net-Net) criteria.

We can thus build a 70% compliant Graham stock portfolio today, using the free Classic Graham Screener alone.

Graham Number(%)

The Classic Graham Screener can also be used to screen stocks by their Graham Numbers.

For example, shown below is the list of stocks selling at a fifth of their Graham Numbers, or less:

Note: The sliders on numerical filters can be adjusted with the mouse, or with the keyboard arrow keys. Filter values can also be typed in.

Finding Graham Stocks Today - Advanced Graham Screening

The Advanced Graham Screener allows us to:

- Fine-tune Graham's rules with more customizable filter combinations.

- View and compare more data per stock, and more stocks per page.

- View stocks with Intrinsic Value(%) values exceeding 70%, and stocks analyzed by other users.

So the very first application of the Advanced Graham Screener would be to get a list of Defensive, Enterprising and NCAV stocks with Intrinsic Value(%) results of 70% or more. Simply screen with the following filters:

Intrinsic Value(%) > 70%

Graham Grade Defensive, Enterprising or NCAV

Analyst GrahamValue

The Advanced Graham Screener can also be used to compare all Graham Ratings — and other data — for any set of stocks of your choice, as shown below.

Note: The Quick Reference section on Graham Ratings may help in understanding this section of the tutorial better.

Other Advanced Screening Strategies

1. See how to screen for stocks exceeding Graham's requirements, such as two-thirds NCAV (Net-Net).

2. The Advanced Graham Screener also allows for some highly Customized Stock Screening Strategies.

A Sample Analysis

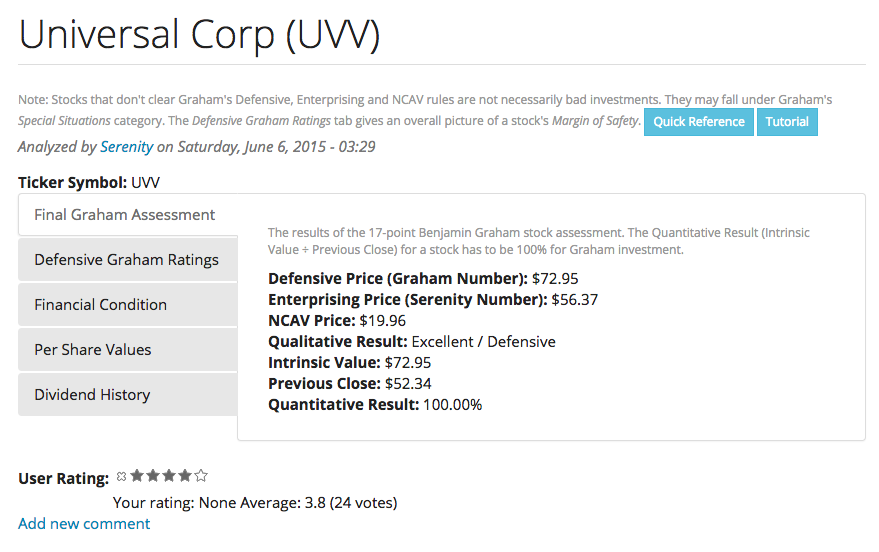

To understand how a full Graham analysis works, let's take the example of Universal Corporation.

In the Financial Condition tab for UVV on GrahamValue, we see the Sales and Balance Sheet figures that were used in the Graham analysis:

This data is used to calculate Graham Ratings such as Assets / Liabilities, Assets / Debt etc., and the NCAV (Net-Net) price.

Any differences in Tangible BVPS and Reported BVPS affect both the Enterprising Price, as well as the Intrinsic Value(%) for Enterprising grade stocks. So every stock on GrahamValue has both the Reported BVPS and Tangible BVPS displayed on it in the Per Share Values tab as shown below. Only the Tangible BVPS is used for evaluating Enterprising grade stocks.

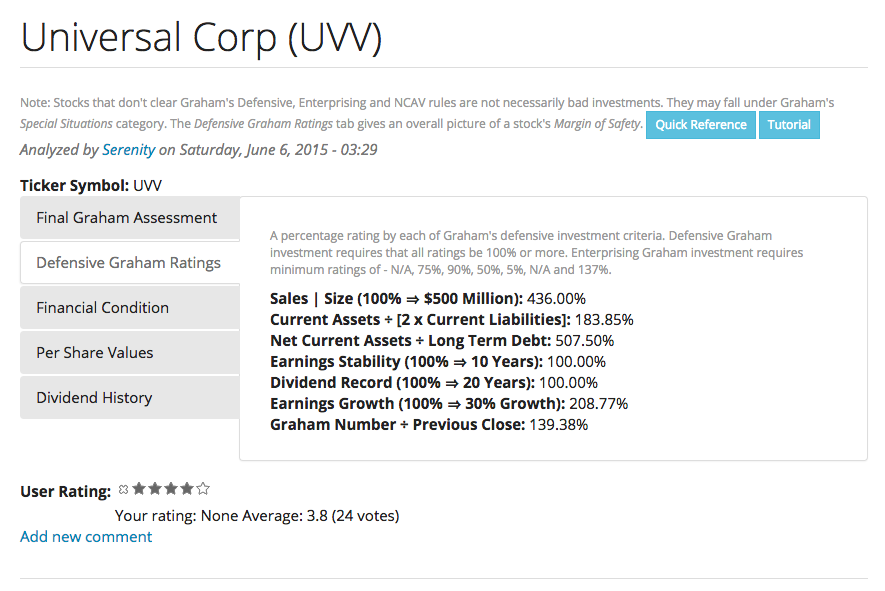

Combining the above data with UVV's dividend history, we get the following Graham Ratings for UVV:

Note: Stocks that don't clear Graham's Defensive, Enterprising and NCAV rules are not necessarily bad investments. They may fall under Graham's Special Situations category. The Graham Ratings tab gives a good overall picture of a stock's Margin of Safety.

Lastly, shown below is the Final Graham Assessment tab for UVV which gives a summary of the Graham analysis.

We see that UVV has different Defensive, Enterprising and NCAV prices. We also see that the Graham Grade for UVV is Defensive and thus, the Defensive Price (Graham Number) is also its Intrinsic Value. Finally, we see that UVV has a Quantitative Result (now called Intrinsic Value(%)) of 100% since its Intrinsic Value is more than its previous closing price.

Thus, not only do we get a full 17-point Graham analysis for UVV, we also see all the data used for the analysis. So once a potential list of stocks for investment is shortlisted using GrahamValue's screeners, the figures used for analysis can (and should) be verified against the annual reports of the individual companies before investment.

To Conclude

In The Intelligent Investor, Graham says "to distill the secret of sound investment into three words, we venture the motto - Margin of Safety". While the popular interpretation of the margin today is to buy stocks with low P/E and P/B ratios, a true Graham Margin of Safety is both qualitative and quantitative as described above.

Graham taught that, over the long run, an investor's returns depend on the amount of intelligent effort he is willing to bring to his investments; and that increased risk — contrary to popular belief — actually reduces returns.

There are those who will say that Graham's principles are outdated, citing Globalization and Technology. But stocks like IBM have existed since Graham's time, and institutions like the World Bank and IMF were established early in the 19th century to regulate international trade. Stock markets have existed for nearly 400 years now; NYSE for 150 years. There really is nothing new under the sun. The proliferation of technology may have made stock markets more competitive, but the fundamental ways in which they work remain the same.

Warren Buffett once gave a speech at Columbia Business School explaining how Graham's record of creating exceptional investors (such as Buffett himself) is unquestionable, and how Graham's principles are everlasting. The speech is now known as The Superinvestors of Graham-and-Doddsville.

Buffett concluded the speech saying:

"Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace, and those who read their Graham & Dodd will continue to prosper."

Next: Read about the Margin of Safety, Graham's notes on selling stocks, and a list of general Value Investing principles.

Video

Though originally published as an article, the above write-up was briefly used as a tutorial on GrahamValue; and formed the basis for the below video.

Facebook Likes and Comments

Submitted by GrahamValue. Created on Monday 27th May 2019. Updated on Wednesday 2nd August 2023.