While the Value Investing framework Warren Buffett's mentor actually recommended was slightly different, he did mention 2/3rd Net Current Asset Value as one of his own strategies.

What Graham Did

Graham did not actually recommend the two-thirds NCAV criteria for his readers. He was simply talking about his own investment operations.

"A cost for each of less than their book value in terms of net-current-assets alone—i.e., giving no value to the plant account and other assets. Our purchases were made typically at two-thirds or less of such stripped-down asset value."

What He Preferred

A little later, Graham writes:

"Our own preference, however, remains for other types that show a combination of favorable investment factors, including asset values of at least two-thirds the market price."

Note that this is in opposition to what he writes earlier. The stocks here would have prices exceeding their asset values — about 1.5 times to be exact — which is actually one of the criteria in his framework for Defensive grade stocks.

What He Suggested

For his readers, Graham actually recommended NCAV stocks with a positive Trailing 12-month Earnings Per Share (often abbreviated as EPS -TTM).

"If one can acquire a diversified group of common stocks at a price less than the applicable net current assets alone—after deducting all prior claims, and counting as zero the fixed and other assets— the results should be quite satisfactory... If we eliminated those which had reported net losses in the last 12-month period we would be still left with enough issues to make up a diversified list."

These are the default criteria for NCAV (Net-Net) grade stocks on GrahamValue.

Applying 2/3rds NCAV

However, GrahamValue does allow screening for stocks using the Two-Thirds NCAV method as well.

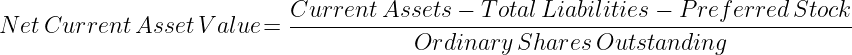

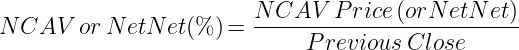

NCAV or Net-Net(%)

GrahamValue's screeners support NCAV or Net-Net(%) ≥ (greater than or equal to) filters because — by definition — the higher a stock's NCAV Price (Net-Net) in relation to the price, the better.

An NCAV or Net-Net(%) of 100% or more on GrahamValue's screeners therefore indicates that the stock's NCAV Price (Net-Net) exceeds its current market price.

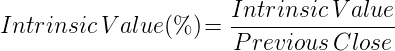

Intrinsic Value(%)

An Intrinsic Value(%) of 100% or more on GrahamValue indicates that the stock's Intrinsic Value exceeds its current market price; and additionally, that the stock completely clears Graham's requirements for its Graham Grade.

Note: Graham Ratings on GrahamValue are defined such that they're better when higher, and that Graham's Defensive requirements default to 100%.

Classic Graham Screener

One can always find all stocks that are simply selling under two-thirds of their NCAV on the free Classic Graham Screener using:

NCAV or Net-Net(%) ≥ 150%

Advanced Graham Screener

But to find NCAV (Net-Net) grade stocks — stocks with a positive EPS (TTM) — selling under two-thirds of their NCAV, one would need to screen for:

Graham Grade NCAV (Net-Net)

Intrinsic Value(%) ≥ 150%

This can be done using the Advanced Graham Screener.

Preset Links

Watch Videos

Warren Buffett

NCAV (Net-Net)

Facebook Likes and Comments

The original link in the Facebook post below has been moved, and Facebook does not allow it to be edited. The updated link has been placed in the description of the post instead.

Submitted by GrahamValue. Created on Friday 20th November 2015. Updated on Tuesday 1st August 2023.